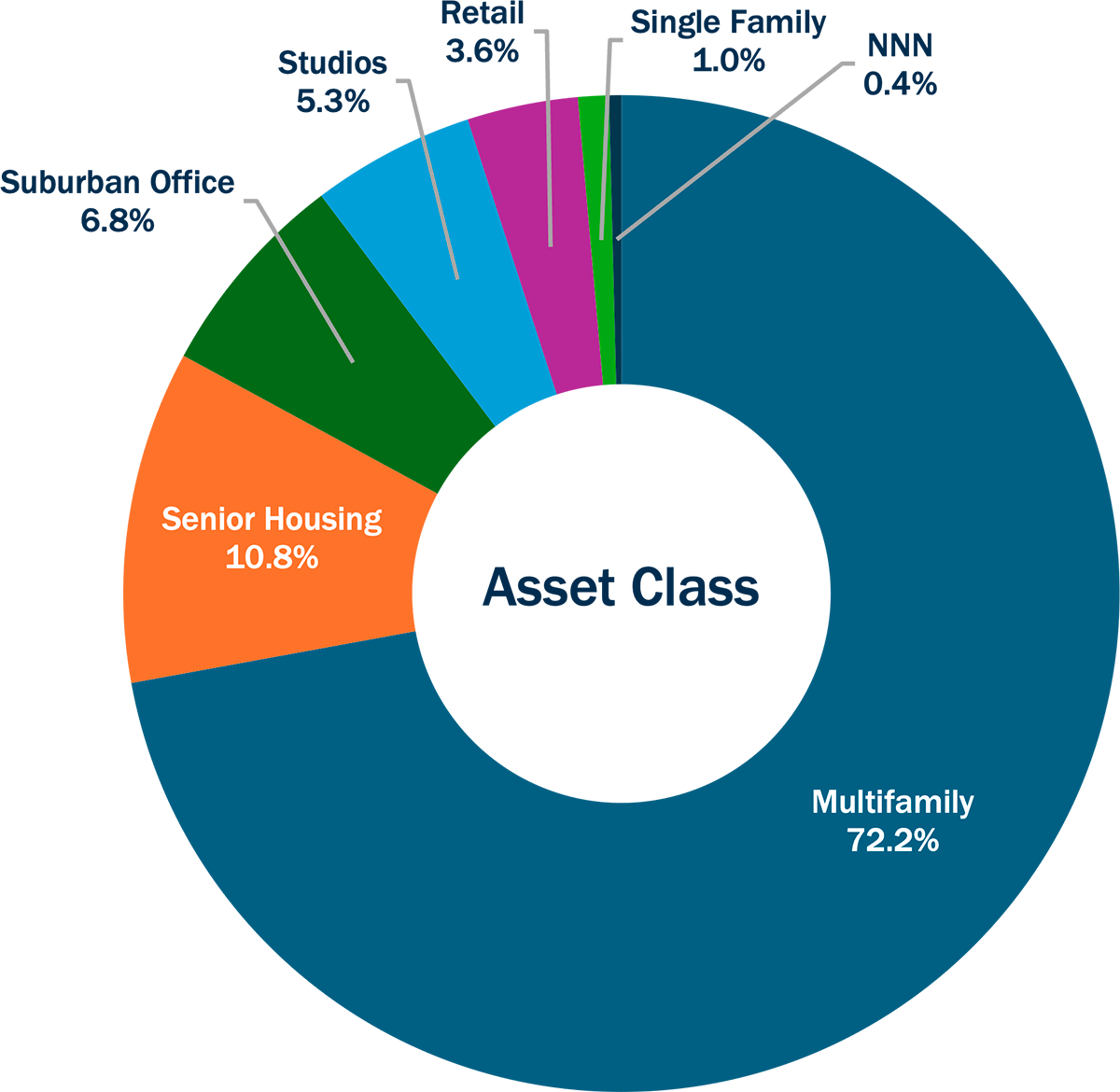

Evolution Investment Management (“Evolution IM” or “EIM”) is a Registered Investment Adviser and asset manager of real estate private equity investments. We have a multi-year track record, with a wide range of creative joint venture structures and a well-diversified portfolio across the United States.

Since inception, Evolution’s management team has deployed capital into more than $5 billion of real estate through eight distinct private equity vehicles, including three real estate opportunity funds, two core-plus separately managed institutional accounts and three sidecar real estate opportunity funds.

EIM originates senior and mezzanine loans secured by commercial real estate. EIM loans fund value-add business plans, including loans to lease-up and stabilize assets, loans on properties that are being repositioned in the market, construction loans, loans on vacant buildings, and loans for discounted payoff and discounted note acquisitions. We also originate permanent loans on stabilized properties.

EIM works with select institutional investors in an advisory capacity on portfolio finance and asset management of strategic or distressed portfolios and individual assets. As an advisor on portfolio finance, EIM’s role is similar to that of a real estate CFO to optimize from the top-down how a portfolio is financed to best suit the client’s short and long-term objectives and to assist with the implementation of the strategy. EIM’s expertise can complement an investor’s existing strategic investment advisory partners. In the capacity of an asset advisor, EIM relies on its integrated debt and equity investment team to advise clients on strategic or distressed assets including asset financing.